- Jason Bond Picks (Member)

- Posts

- 5 penny stock swing trades

5 penny stock swing trades

And LQMT insider buying

Good morning,

Happy Thanksgiving! I’m grateful for you guys and gals.

The chat room is bustling with ideas as offices close and subscribers trade from home this week. Join us in the chat room or watch your APP for new trade ideas from the master penny stock watchlist.

As I pick up the pace of small-cap swing trades, I wanted to do a refresher on the biggest mistakes I’ve made when trading penny stocks. The lesson was recorded live on Saturday and is on-demand here. Stay tuned for more video lessons.

Markets are closed Thursday and open Friday but only until 1P E.

I’m in DDD, ANGI, PRPL, MRAI, and VERI swings. The goal is -3% stop losses and +5-20% profits.

And more good news last night for my long-term LQMT position.

CEO Chung filed a form 4 (insider buys) Tuesday night after scooping up about a million shares between $.049-$.064.

If you missed Tuesday morning’s update (yesterday), I’ve included it again.

LQMT went up 34% Monday and 13% Tuesday. There are a few catalysts driving it since the 10-K last week.

First, speculation that the ~$100,000 from the pinion gear prototype leads to production, an 8-K and favorable press release. This technology is a big deal and NASA is in the game. The market for pinion gears is huge and while it’s a long shot, Tesla’s new Cybertruck is a brand new technology. Li’s Eontec already makes Model X door-lock cases for Tesla. The Cybertruck launch will come and go, but the speculation of that pinion gear prototype going into production will remain and hopefully lead to a whale contract.

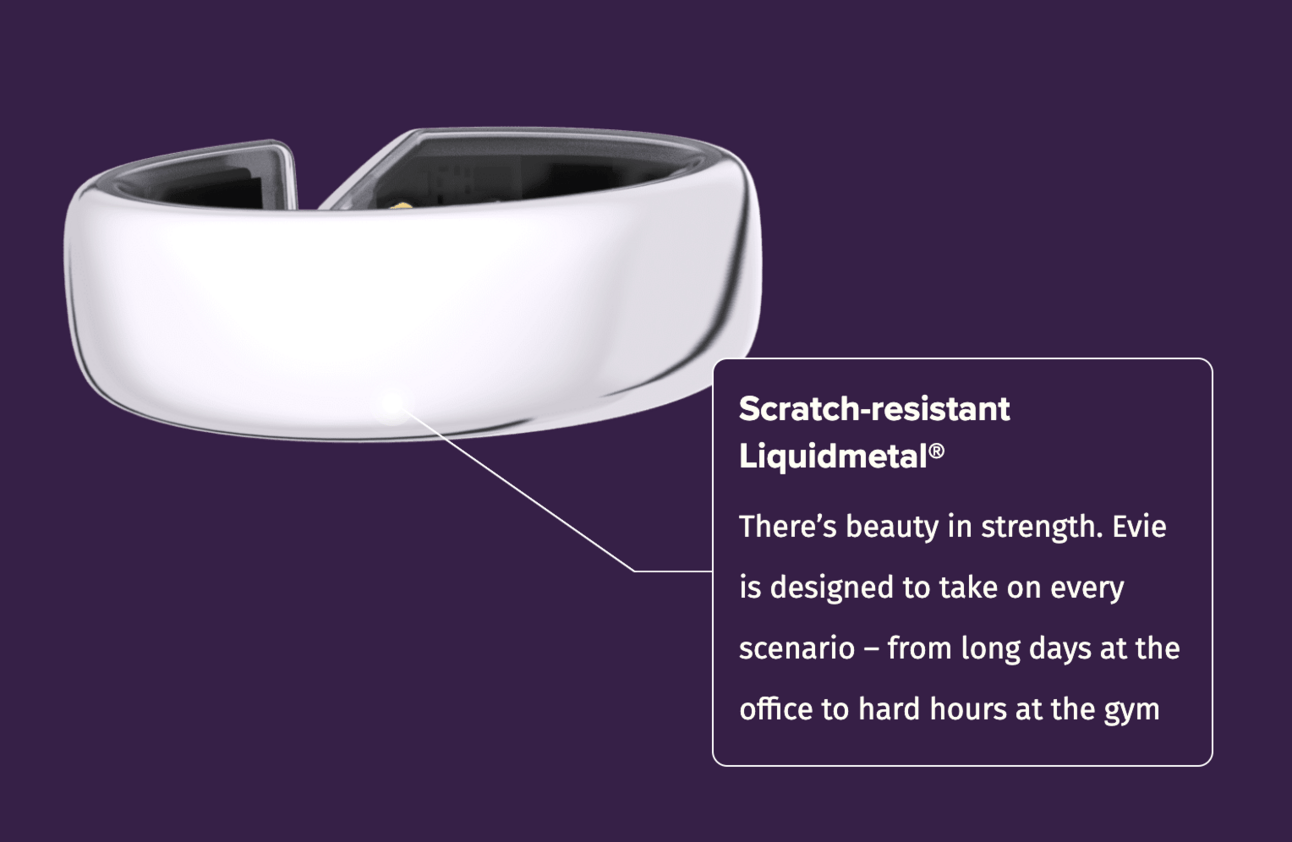

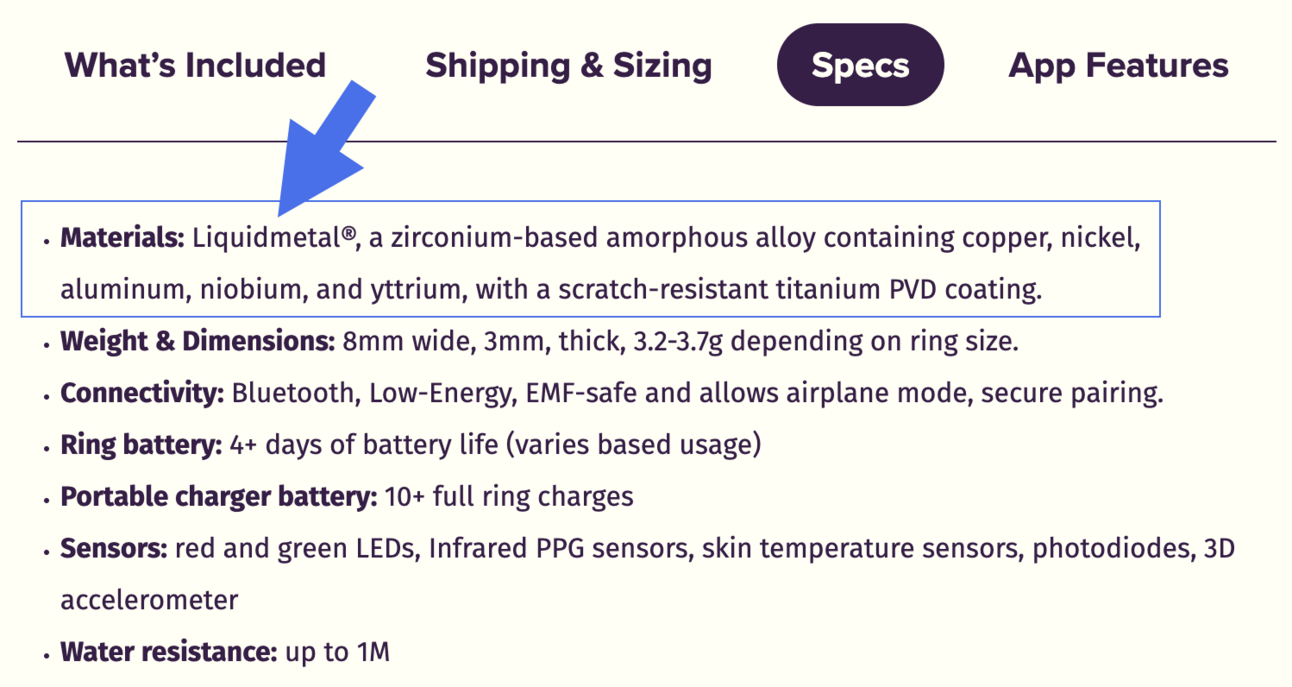

Second, the other big catalyst I see is Monday’s launch of the Evie Ring by Movano Health. Turns out orders started Monday and it’s made of Liquidmetal. This is likely to lead to an 8-K and favorable press release.

Movano has submitted the device for FDA medical clearance, passed the first milestone of the review process, and is now under full review by the FDA.

All three of these catalysts are very real and should continue to drive the stock because they could lead to favorable 8-K press releases in the coming months.

As I pointed out after the 10-K, there’s very little liquidity on the level II ask, meaning it shouldn’t take much for this to climb to $.10 soon.

Finally, the last catalyst is Li raising $15M recently. Some speculate he might soak up shares under $.10 and take full control of the company, and while I like the idea, it’s impossible to know what he plans to do with that cash. The above catalysts are very tangible.

Happy Thanksgiving.

Jay

Questions or concerns about our products? Email [email protected]

© Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC ("RagingBull") subscription, website, application or other service ("Services"), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers' trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.